20 Oct LVMH’s strategic acquisitions from its inception to 2024

LVMH’s strategic acquisitions from its inception to 2024

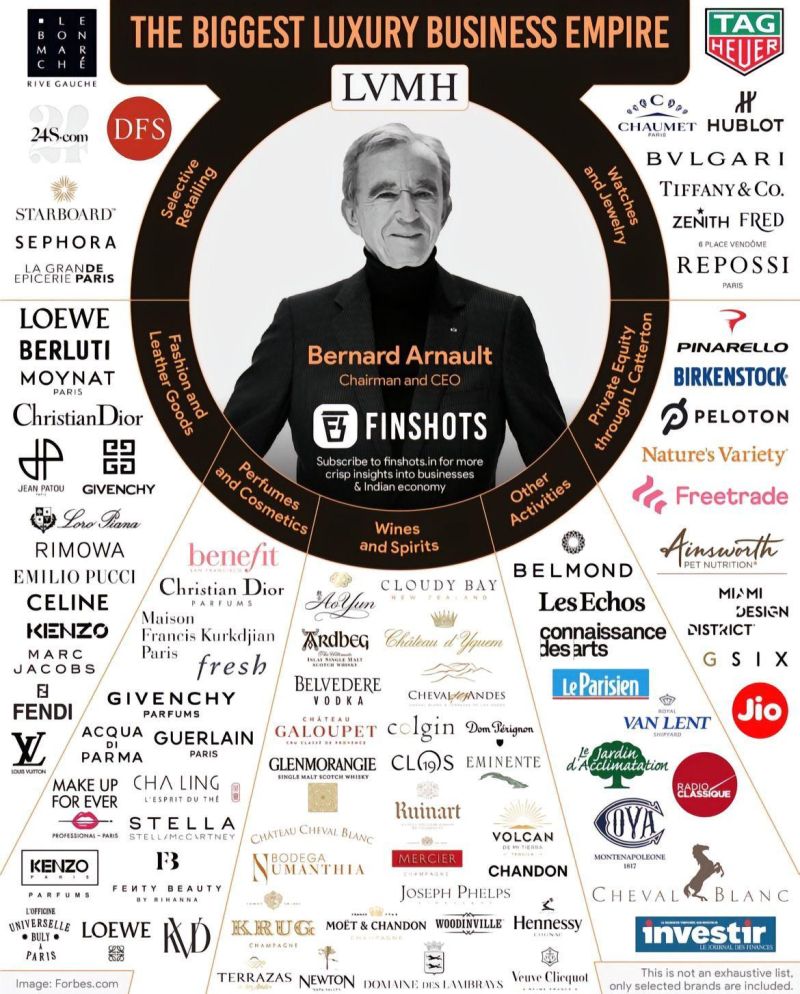

LVMH Moët Hennessy Louis Vuitton, commonly known as LVMH, has become a titan in the luxury goods industry through a series of strategic acquisitions spanning nearly four decades. This article delves into the company’s most significant purchases, exploring how each acquisition has contributed to LVMH’s growth and dominance in the global luxury market. LVMH’s strategic acquisitions from its inception to 2024.

The Birth of a Luxury Empire (1987)

LVMH’s story begins in 1987 with the merger of Louis Vuitton and Moët Hennessy. This foundational merger brought together two powerhouses in their respective fields:

- Louis Vuitton: A leader in luxury leather goods and fashion

- Moët Hennessy: A dominant force in the champagne and cognac markets

This merger laid the groundwork for what would become the world’s largest luxury goods conglomerate, setting the stage for decades of strategic acquisitions.

Early Acquisitions: Building the Foundation (1988-1993)

In the years immediately following its formation, LVMH began to expand its portfolio:

- 1988: Acquisition of Givenchy

- 1993: Acquisition of Kenzo

- 1994: Acquisition of Guerlain

These early acquisitions demonstrated LVMH’s strategy of acquiring prestigious brands with rich histories and global recognition. Each of these brands brought unique strengths to the LVMH portfolio:

- Givenchy: Haute couture and ready-to-wear fashion

- Kenzo: Innovative and multicultural fashion designs

- Guerlain: Luxury perfumes and cosmetics

Expanding the Empire: Key Acquisitions of the 1990s

The 1990s saw LVMH significantly broaden its reach across various luxury sectors:

1996: Céline and DFS Group

LVMH acquired Céline, expanding its presence in the ready-to-wear and leather goods markets. In the same year, the company made a significant move into retail by investing in the DFS Group, a duty-free retail chain.

1997: Marc Jacobs and Sephora

The acquisition of Marc Jacobs brought a contemporary American designer into the LVMH fold. The purchase of Sephora marked LVMH’s entry into beauty retail, providing a platform for selling its fragrances and cosmetics directly to consumers.

1999: Tag Heuer

The acquisition of Tag Heuer for an estimated $739 million solidified LVMH’s presence in the luxury watch market, adding a brand known for its sports watches and chronographs.

The New Millennium: Consolidating Power (2000-2010)

The turn of the century brought some of LVMH’s most high-profile acquisitions to date:

2000: Emilio Pucci

LVMH acquired Emilio Pucci, the Italian fashion house known for its geometric prints and vibrant colors.

2001: Fendi (Majority Stake)

LVMH acquired a majority stake in Fendi for an estimated $259.4 million, strengthening its position in the Italian luxury market.

2010: Bulgari

The acquisition of Bulgari for €3.7 billion significantly boosted LVMH’s presence in the jewelry and watch sectors. This move positioned LVMH as a major player in the hard luxury segment.

Strategic Growth and Innovation (2011-2019)

The 2010s saw LVMH continue its acquisition strategy while also focusing on innovation and digital transformation:

2013: Loro Piana

LVMH acquired an 80% stake in Loro Piana, an Italian luxury textile and clothing company known for its high-quality cashmere and wool products.

2015: Investment in Lyst

Recognizing the growing importance of e-commerce, LVMH invested in Lyst, a fashion search platform, as part of a $60 million funding round.

2016: Rimowa

LVMH acquired an 80% stake in Rimowa, the German luxury luggage manufacturer, for €640 million, marking its first German acquisition.

2017: Christian Dior

In a complex €12 billion transaction, LVMH consolidated its ownership of Christian Dior, bringing the entire Christian Dior brand under the LVMH umbrella.

2019: Belmond Ltd.

LVMH made a significant move into the luxury travel sector with the acquisition of Belmond Ltd. for $3.2 billion. This purchase included luxury hotels, trains, and even a cruise ship, marking LVMH’s expansion beyond physical goods into experiences.

Recent Acquisitions and Future Outlook (2020-2024)

The most recent years have seen LVMH continue its strategic acquisitions, even in the face of global challenges:

2021: Tiffany & Co.

The most significant acquisition in LVMH’s history was the purchase of Tiffany & Co. for $15.8 billion. This deal, finalized in January 2021 after some pandemic-related complications, significantly strengthened LVMH’s position in the jewelry market and expanded its presence in the crucial U.S. market.

2022: Joseph Phelps Vineyards

LVMH acquired Joseph Phelps Vineyards, a renowned Napa Valley winery, further expanding its wine and spirits portfolio.

2023: Barton Perreira

To bolster its luxury eyewear division, LVMH acquired Los Angeles-based eyewear brand Barton Perreira for $80 million.

Impact of LVMH’s Acquisition Strategy

LVMH’s strategic acquisitions have had a profound impact on both the company and the luxury industry as a whole:

Financial Performance

LVMH’s acquisition strategy has been a key driver of its financial success. According to the company’s financial reports, LVMH reported a net profit of €15.2 billion on revenue of €86.2 billion in 2023. This represents significant growth over the years, largely fueled by its strategic acquisitions.

Market Dominance

Through its acquisitions, LVMH has achieved unparalleled market dominance in the luxury sector. The company now operates in multiple segments:

- Fashion & Leather Goods

- Wines & Spirits

- Perfumes & Cosmetics

- Watches & Jewelry

- Selective Retailing

This diversification has allowed LVMH to weather economic downturns and capitalize on growth opportunities across various luxury categories.

Brand Rejuvenation

One of LVMH’s key strengths has been its ability to acquire heritage brands and rejuvenate them for modern consumers. Brands like Louis Vuitton, Dior, and Bulgari have seen significant growth under LVMH’s ownership, thanks to strategic investments in marketing, product development, and retail expansion.

LVMH’s Acquisition Philosophy

LVMH’s acquisition strategy is characterized by several key principles:

Preserving Brand Identity

A crucial aspect of LVMH’s acquisition strategy is its commitment to preserving the unique identity of each brand it acquires. Rather than homogenizing its portfolio, LVMH allows each maison to maintain its individual character and heritage.

Synergies and Shared Resources

While preserving brand identities, LVMH leverages its scale to create synergies across its portfolio. This includes shared resources in areas such as supply chain management, distribution networks, and marketing expertise.

Long-Term Vision

LVMH’s acquisition strategy is characterized by a long-term vision. The company is willing to invest significantly in acquired brands, often taking years to fully realize their potential. This patient approach has allowed LVMH to build a portfolio of enduring luxury brands.LVMH’s strategic acquisitions from its inception to 2024.

Challenges and Criticisms

Despite its success, LVMH’s acquisition strategy has faced some challenges and criticisms:

Antitrust Concerns

LVMH’s growing dominance in the luxury sector has occasionally raised antitrust concerns. The company’s size and market power have led to scrutiny from regulators, particularly in Europe.

Cultural Preservation

Some critics have expressed concerns about the potential homogenization of luxury brands under large conglomerates like LVMH. However, the company has largely managed to maintain the distinct cultural identities of its acquired brands.

Sustainability and Ethical Considerations

As consumer awareness of sustainability and ethical practices grows, LVMH faces increasing pressure to ensure that its acquisitions and operations align with these values. The company has responded with initiatives like its LIFE 360 environmental strategy, but continues to face challenges in this area.

Future Outlook

Looking ahead, several factors are likely to influence LVMH’s acquisition strategy:

Potential Acquisition Targets

While LVMH keeps its plans close to the chest, analysts often speculate about potential acquisition targets. Independent luxury brands that could complement LVMH’s existing portfolio are often mentioned as possibilities.

Emerging Markets

LVMH’s acquisition strategy is likely to continue focusing on opportunities in emerging markets, particularly in Asia. The company has already made significant inroads in China and is likely to seek further growth in other developing economies.

Digital and Technology Integration

As the luxury industry becomes increasingly digital, LVMH may look to acquire or invest in technology companies that can enhance its e-commerce capabilities, customer experience, and supply chain efficiency. The company’s partnership with Alibaba to expand its presence in China is an example of this focus on digital growth.

Conclusion

LVMH’s history of strategic acquisitions tells a story of visionary leadership, market dominance, and the creation of a true luxury empire. LVMH’s strategic acquisitions from its inception to 2024, LVMH has demonstrated an unparalleled ability to identify, acquire, and grow luxury brands across various sectors. The company’s acquisition strategy has not only driven its financial success but has also shaped the global luxury market. By preserving the unique identities of its acquired brands while leveraging group-wide synergies, LVMH has created a portfolio that spans the entire spectrum of luxury goods and experiences.

As we look to the future, it’s clear that acquisitions will continue to play a crucial role in LVMH’s growth strategy. The company’s ability to navigate challenges such as digital transformation, changing consumer preferences, and sustainability concerns will be key to its continued success.For luxury brands, investors, and consumers alike, LVMH’s acquisition history provides valuable insights into the evolution of the luxury market and the power of strategic brand portfolio management. As the luxury landscape continues to evolve, all eyes will be on LVMH to see how it shapes the industry in the years to come.