06 Feb Where Do most Billionaires Store Their Money

Where Do Most Billionaires Store Their Money?

Introduction

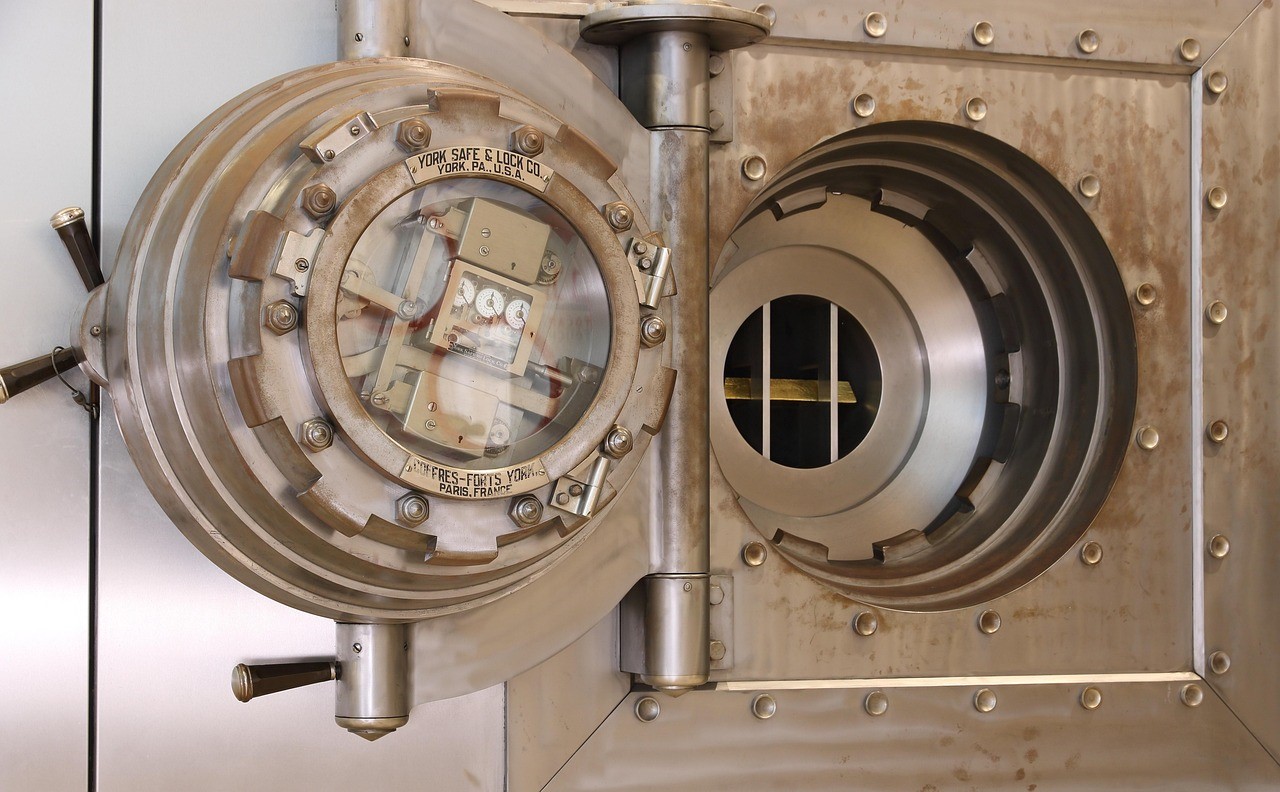

Where Do most Billionaires Store Their Money. Billionaires have vast amounts of wealth, but where do they keep their money? Unlike the average person, they don’t just store it in a traditional bank account. Instead, they diversify their assets across multiple vehicles to maximize security, returns, and tax benefits.

1. Offshore Bank Accounts

One common strategy is using offshore accounts. Countries like Switzerland, Singapore, and the Cayman Islands offer financial privacy and tax advantages. These accounts protect assets from political instability and lawsuits.

2. Real Estate Investments

Billionaires invest heavily in real estate. They own luxury properties, commercial buildings, and land in prime locations. Real estate provides a stable asset that appreciates over time while generating passive income through rentals.

3. Stocks and Equities

A large portion of billionaire wealth is tied to stocks. They invest in blue-chip companies, IPOs, and index funds. Many billionaires, like Warren Buffett and Jeff Bezos, hold significant shares in their own companies, ensuring long-term wealth accumulation.

4. Private Equity and Hedge Funds

Billionaires often invest in private equity and hedge funds. These funds allow access to exclusive investment opportunities and provide high returns. Private equity investments support startups and established businesses, generating exponential wealth.

5. Cryptocurrencies and Digital Assets

In recent years, digital assets have gained popularity among billionaires. Bitcoin, Ethereum, and NFTs serve as alternative stores of value. Cryptocurrencies provide financial independence and hedge against inflation.

6. Collectibles and Luxury Goods

Some billionaires store wealth in rare art, classic cars, and jewelry. These tangible assets appreciate over time and act as a hedge against economic downturns. Notable collectors like Elon Musk and Bernard Arnault use this strategy.

7. Trusts and Foundations

Wealthy individuals utilize trusts to manage and protect their money. Trusts offer tax benefits and ensure that wealth is transferred efficiently across generations. Billionaires also create foundations to support philanthropic causes while maintaining financial control.

8. Government Bonds and Treasury Securities

Billionaires invest in government bonds for stability and security. U.S. Treasury securities provide low-risk returns and serve as a safeguard during financial crises.

9. Business Ventures and Startups

Many billionaires reinvest their wealth into new business ventures. They fund startups, acquire companies, and expand their existing businesses. This strategy not only increases their wealth but also drives innovation and economic growth.

10. Gold and Precious Metals

Gold has been a reliable store of value for centuries. Many billionaires keep a portion of their wealth in gold and other precious metals as a hedge against economic instability and currency devaluation.

Conclusion

Billionaires don’t just store their money in banks. They diversify their wealth across multiple asset classes to ensure security, growth, and financial independence. From real estate to stocks, offshore accounts to cryptocurrencies, their strategies provide stability and long-term prosperity.